The recent American intransigence over the debt ceiling has left many global investors re-thinking their personal investment portfolios. Some questions focus on how Barack Obama became president and how something like this could happen. The truth is, U.S national debt is nothing new. For years, going back to the presidency of Ronald Reagan, the U.S. national debt has been a serious issue for more than 35 years.

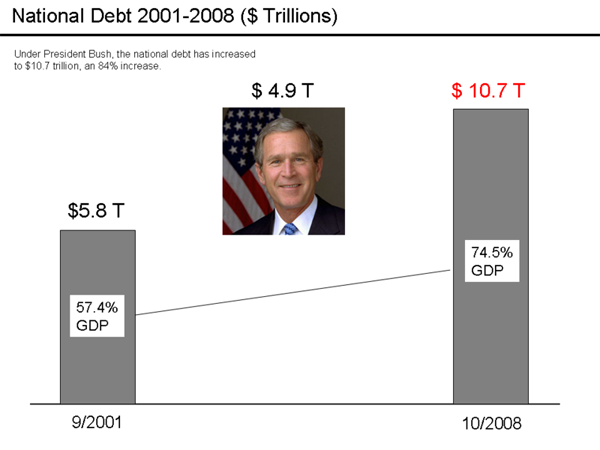

During the eight year presidency of George W. Bush, the national debt of the United States increased more than 84 percent. The total national debt now stands at over US $14 trillion. For those of you who are not clear on exactly how much money that is, allow me to explain: One thousand million equals a billion, and one thousand billion equals a trillion—now that’s a lot of money.

Furthermore, there is a sleeping time bomb sitting in Washington and all state legislatures, which is the unfunded debt accumulated by the federal and state governments. To figure out the unfunded federal debt of the United States, simply take the U.S. government's total liabilities, set it aside as a lump sum, add interest and subtract projected future taxes. What’s left is the total U.S. federal government’s unfunded debt.

Some liabilities on the list of unfunded debt include Social Security, Medicaid, and state or federal government bonds coming due. This significantly increases the national debt to well beyond the existing amount of US $14 trillion plus to something closer to US $35 trillion. And that’s a conservative guess. Both party plans, Democrat and Republican, simply postpone the inevitable without declaring default. The reality is much harsher. This crisis will see massive cutbacks in U.S. government spending, which will bring many Americans to the point of homelessness.

The debt problem will not be solved tomorrow, and in fact, will hold the American economy hostage for several decades to come. The idea the United States of America defaults and is officially bankrupt, something most people have been saying for many years, now certified and endorsed by the bond and credit rating agencies, essentially leaves the world at the edge of a dark precipice of another Great Depression, whether they pass the Bill or not. In the near future, U.S. market share will shrink with China and India taking the lead in economic growth. However, those markets are not secure either because of their internal politics, cultural beliefs, and pressure from population growth.

So, where to invest in an uncertain world? Canada, that’s where. Canada is a safe and secure place to invest for the long-term and beyond. Canada is the future. A society where religious freedom and freedom of speech are guaranteed. Most blue chip companies in Canada are solid and pay a decent dividend. Canada is a resource-based economy selling more oil to the U.S. than Saudi Arabia.

In fact, Canada sells the majority of its energy to the U.S. and is seeking to expand its sales to China and beyond. The country boasts 25 percent of the world’s fresh water, and is a good stable neighbour to the United States of America. Indeed, Canada will become a closer strategic ally as America realizes Canada’s importance to the world economy.

With the recent election of Stephen Harper and his Conservative majority government, it is said Canada’s stability during this global monetary crisis will continue to be a positive influence on the overall North American economy. Investing in Canadian stocks on the Toronto Stock Exchange will only help to influence that stability.

Obama’s speech , addressing the U.S. political intransigence calling his political system less than Triple A, is a slap in the face to most Republicans who indeed need to be scorned for their reckless actions. President Barack Obama has had to fight for every inch of his presidency. He has been treated like the enemy within. This lack of respect goes back to his very first State of the Union address in 2009, when South Carolina Republican Joe Wilson yelled, “You lie.” A shameful example of disrespect.

The world now sees the real face of America, and it is truly sad. Failing to address the U.S. national debt negatively affects world opinion as well as the global economy. The idea the first black American president must endure all, even questioning his American birth, leaves the rest of the world shaking its head in disbelief. Such a good man abandoned by his countrymen and a victim of the most sleazy politics, the politics of race. Indeed, what has become of America?

In my view, Canada will continue to be a staunch U.S ally. But let me be clear, Canada, though not perfect, is a progressive society with little tolerance for racism or hate. Without doubt, Canada is the future and our American friends south of the border can learn a few things about managing debt, universal healthcare and banking—by simply looking North.